Video Game Development Cluster Becomes a Force in Capital Region’s Creative Economy

CEG’s first-of-its-kind regional survey finds cluster employs 350+, majority of studios are hiring

The Capital Region’s video game development cluster has become a recognized force in the local creative economy and is poised to get bigger, with a majority of studios reporting hiring plans for the next 12 months, according to the findings of a Center for Economic Growth (CEG) survey announced today at the Tech Valley Center of Gravity’s “The Business of Digital Games” conference in Troy.

“In the Capital Region, video games are entertaining but they are also impacting the economy. The video game development cluster is something that has been organically growing here for more than two decades. Between the software development and artistic talent that comes out of our colleges and universities, the vast startup support infrastructure under Innovate 518, and our unmatched quality of life, this cluster has found fertile ground here and is thriving,” said CEG President and CEO Andrew Kennedy.

“The video game industry can become a long-term economic engine for the Capital Region. To do this we’ll need to translate our unique assets to make it a destination for talent, capital and entrepreneurs,” said Guha Bala, one of the region’s pioneering video game developers who recently launched Velan Studios in Troy.

Cluster Profile

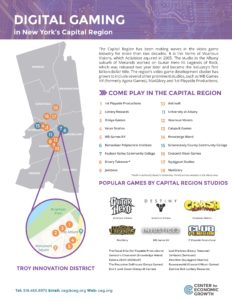

In February 2018, CEG surveyed 14 video game studios throughout the region. A third of them are located in Troy, the reinvigorated waterfront city, dubbed “Upstate’s Brooklyn,” that is the heart of the region’s gaming and technology hub. From March 19 to 23, CEG will be showcasing these survey findings at the Game Developers Conference in San Francisco.

The CEG survey found the region has at least 14 active video game studios1 that employ 352 people, with 285 of them being software developers. That means roughly one in 10 software developers in the region work in the video game development cluster. That also made the cluster larger than other major creative economy industries in the region, such as graphic design services, book publishing and public relations agencies, according to data of private sector wage and salary and self-employed workers from Economic Modeling Specialists Inc. (EMSI). Only four of the studios surveyed are solo operations, though most of them rely on contractors for graphic design, music and other support services. While none of the solo studios reported plans to take on employees over the next 12 months, eight of the other 10 will be hiring during that period.

The age of studios ranged from one year to 27 years, with the average age being 9 years old. In total, the studios have produced more than 422 games. Consoles and PCs tied as the leading game platform (nine studios each), followed by mobile (8 studios studios) and web (six studios).

Ten studios attributed their presence in the Capital Region to their founders’ roots in the area or enrollment at a local college or university. Six studios also attributed their presence in the Capital Region to its quality of life, technology assets and/or gaming environment. These are the types of attributes that have been driving the Capital Region up on national rankings. For example, U.S. News and World Report has named the Albany-Schenectady-Troy metro area the nation’s third best place for technology jobs, Forbes named it the 21st best city for young professionals and Business Insider ranked it as the nation’s 30th best place to live.

Capital Region Gaming Background

The Capital Region is home to Vicarious Visions, the studio that Activision acquired in 2005 that and worked on “Guitar Hero III: Legends of Rock,” the industry’s first billion-dollar title. The studio was founded in 1991 by two brothers in high school, Karthik and Guha Bala, and is currently based in the Albany suburb of Menands. The region’s video game development cluster has grown to include several other prominent studios, such as WB Games NY (formerly Agora Games), MadGlory and 1st Playable Productions.

“Our industry is dynamic,” said Guha Bala. “At its current scale in our region, we could grow it much larger, or lose it. There are many regions that will compete for talent, capital and entrepreneurs that should make their home here. So, we have a window of opportunity in the next three to five years to translate our unique advantages into a critical mass of game industry jobs and companies that would make it a sustainable economic cluster which can withstand the volatility of our industry and make it one of the best places in the world to make games.”

The Capital Region’s video game development cluster is now concentrating in Troy. That is where Empire State Development is investing $150,000 annually to establish a Digital Gaming Hub at the Rensselaer Polytechnic Institute (RPI), which Animation Career Review named the nation’s 10th best game design school. Troy is also the home of the Bala brothers’ newest venture, Velan Studios, which recently raised $7 million in Series A financing.

With the Capital Region Economic Development Council in its 2017 Progress Report identifying the establishment of a video gaming hub as a new regional priority, even more opportunities are opening for game developers and studios.

Opportunities & Challenges

Looking to the next 12 months, nine studios indicated they saw opportunities in the release of new games or the expansion of offerings. Other areas of opportunity included product demonstrations/marketing (four studios) and visualization/design technology (three studios).

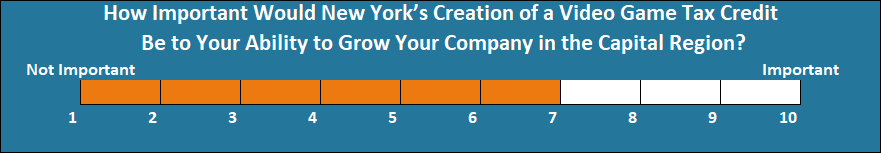

For the cluster to further grow in the region, studios placed the greatest emphasis on improved access to venture capital, grants or loans and an improved tax environment (four studios each). The availability of STEM talent and quality of life enhancements tied as the cluster’s second greatest need (three studios each). When asked to measure the importance that a video game tax credit would have on their business, with one being the least and 10 being the most important, the studios provided an average response of seven.

The biggest challenge that studios identified for the next 12 months centered on sales and marketing (six studios). The marketing concerns ranged from finding qualified staff, standing out in an intensely competitive industry and the costs of social media advertising. Talent acquisition and finances/funding tied as studios’ second biggest concern (five studios each).

The biggest challenge that studios identified for the next 12 months centered on sales and marketing (six studios). The marketing concerns ranged from finding qualified staff, standing out in an intensely competitive industry and the costs of social media advertising. Talent acquisition and finances/funding tied as studios’ second biggest concern (five studios each).

Talent Pipeline

Creating the talent to meet this demand is RPI’s Games and Simulation Arts and Sciences (GSAS), which led Animation Career Review to rank the university as the 10th best game design school (2017), 41st best graphic design school (2018) and 48th best animation school (2018). Between 2014 and 2016, RPI awarded 79 Game and Interactive Media bachelor’s degrees – the 10th most in the nation, according to data from the Integrated Postsecondary Data System (IPEDS).

“This report highlights the remarkable wealth of talent in digital games that’s been quietly growing in the Capital Region, and RPI is proud of our role in developing this cluster. The support from Empire State Development is an important step towards truly putting both the region and New York State as a whole on the map in the games industry,” said RPI’s GSAS Director Benjamin Chang.

Other video game-related programs, either in software development or digital art, are also offered at regional institutions such as the University at Albany, Hudson Valley Community College (HVCC) and Schenectady County Community College (SCCC). Albany Can Code also providers software coder training for non-traditional students at HVCC and SCCC.

Video Game Studio Startup Support

Nine of the studios surveyed reported utilizing the Capital Region’s entrepreneurial ecosystem, which includes incubators, such as the Tech Valley Center of Gravity (TVCOG); accelerators, such IgniteU NY and NYBizLab; and co-working spaces, such as the Troy Innovation Garage. Studios also reported benefiting from RPI’s Incubator and Center for Automation Technologies and Systems (CATS) programs. All of them are part of Innovate 518, a state-designated Innovation Hot Spot that orchestrates the Capital Region’s entrepreneurial support ecosystem. Several studios also participated in local networking and meet up groups, such as the Tech Valley Game Space, Startup Tech Valley and Saratoga TechOUT.

“Innovate 518 works hard to fuel entrepreneurial growth within the Capital Region leveraging our expansive network of incubators, accelerators and co-working spaces, and it’s gratifying to see those efforts flourish into a burgeoning video game cluster,” said Matt Grattan, director of community and economic development at the University at Albany. “In partnering with our Innovation (NYSTAR) programs, the RPI Digital Gaming Hub and many others, I’m confident we’ll witness continued progress toward our area becoming the East Coast hub for video game development.”

“At Tech Valley Center of Gravity, we see first-hand every day the rising wave of creative, technical and entrepreneurial spirits drawn to or rooted in Troy,” said TVCOG Executive Director Holly Cargill-Cramer. “Tech Valley Game Spaces’ Orbit Mentorship groups, Social Nights, Lesson Nights and Transmissions pod casts, Ludum Dare events, Game Jams, and meetings of the International Game Designers Association fill our rooms and our calendar. Velan Studios employees take advantage of corporate membership in our makerspace and start-up studios populate our co-working area.”

CEG Services for Video Game Studios

CEG’s Business Growth Solutions (BGS) unit can also help studios surmount many of the obstacles identified in the survey. BGS’s services for studios include:

• Sandler Training: Equips staff with highly effective sales methodologies.

• Start-up Mentoring: Pairs entrepreneurs with seasoned business leaders who help guide them to growth

• Tech Acceleration: Provides assistance with design and prototyping, market intelligence and assessments of state and federal funding opportunities such as Small Business Innovation Research (SBIR) grants.

• VentureB Coaching and Pitch: Helps entrepreneurs sharpen their venture pitches and meet potential investors.

To further support this cluster, CEG in February partnered with the Upstate Alliance for the Creative Economy (ACE) to highlight the diversity, size and impacts of the Capital Region’s creative economy, which includes video game studios. CEG and ACE are hosting six business roundtables throughout the region to collect ideas on how best to grow creative jobs and opportunities.

Notes

1 One of the studios surveyed, Binary Takeover, is legally based in Ocklawaha, Florida, but it has several members in Albany and Troy.

For additional information or to talk to CEG President and CEO Andrew Kennedy, please contact CEG Director of Research and Communications James Schlett at 518-465-8975 X221 or jamess@ceg.org.

Don’t miss these insights into the trends that are shaping the Capital Region’s economy. Sign up for CEG’s e-news and follow us on: