The Capital Region’s 2017 Economic Performance

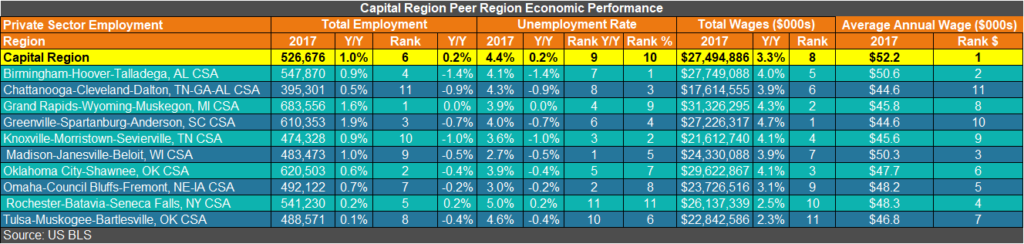

The Capital Region’s annual job growth was on par with its 10 peer economic regions in 2017. Although the peer regions had lower unemployment rates than the Capital Region, they are also dealing with more austere labor force shortages and greater wage inflation, according to a Center for Economic Growth (CEG) analysis of data from the U.S. Bureau of Labor Statistics (BLS).

Peer Group

CEG compared the eight-county Capital Region’s annualized economic performance to those of 10 combined statistical areas (CSAs) with commutersheds1 that are of similar geographic size and population density. CSAs reflect strong commuting patterns that are “less intense than those captured by mergers [for metropolitan and micropolitan statistical areas (MSAs or µSAs)], but still significant.”

Performance

With a 1 percent year-over-year increase in jobs, the Capital Region was the sixth fastest-growing region in the 11-region peer group. However, the region’s unemployment rate of 4.4 percent was the ninth highest in the peer group, and its .02 percentage point increase over the year made it the 10th fastest-growing rate.

The Capital Region’s higher unemployment rate appears to have reduced some of the wage inflation pressures that drove average annual wages up by as much as 3.5 percent in the Oklahoma City-Shawnee CSA, which had an unemployment rate of 3.9 percent. The Madison-Janesville-Beloit CSA had the lowest unemployment rate of the group (2.7 percent) and its average annual wage increased by 2.9 percent. Despite the slower wage growth, the Capital Region already had the highest average annual wage among the group, at $52,200.

Here were the peer group’s leaders for the following categories:

- Total Job Growth (Y/Y): Grand Rapids-Wyoming-Muskegon, MI CSA, 1.6 percent

- Unemployment Rate (%): Madison-Janesville-Beloit, WI CSA, 2.7 percent

- Unemployment Rate (Y/Y): Birmingham-Hoover-Talladega, AL CSA, -1.4 percent

- Total Wages (Y/Y): Greenville-Spartanburg-Anderson, SC CSA, $27.2 billion

- Average Annual Wages ($): Capital Region, $52,200

Manufacturing

The Capital Region’s manufacturing sector registered an average performance in the peer group, ranking sixth for employment growth (1.3 percent) and fifth for establishment growth (1.3 percent). Manufacturing accounted for 6.5 percent of the Capital Region’s private sector employment, compared to the group average of 12.1 percent.

CEG Activities to Support Industry Growth

CEG’s activities to lower the unemployment rate and bolster the region’s talent pipeline include the following:

• CEG recently received $250,000 from KeyBank to support the below manufacturing training programs:

• Expansion of HVCC’s Manufacturing Technology Pathways Project, a short-term, stackable credential training program, or “boot camp.” HVCC launched this training program in January 2017. It involves an manufacturing boot camp that includes online courses, in-person instruction.

• Launch of the Certified Production Technician (CPT) program at SUNY Schenectady County Community College (SCCC). The CPT program is an eight- to 12-week-long certificate course that is intended to skill-up incumbent workers or unemployed workers with experience in the sector. There are five individual certificate modules: safety; quality practices and measurement; manufacturing processes and production; maintenance awareness and green production.

• CEG is also sponsoring a Manufacturing Intermediary Apprenticeship Program (MIAP) to assist local manufacturers in training workers for high-skill trades. Through its partnership with the Manufacturers Association of Central New York (MACNY), Capital Region manufacturers in May started onboarding apprentices into the program.

• CEG’s Business Growth Solutions (BGS) offers technical services to help Capital Region manufacturers with optimal improvement, strategic growth, sustainability and energy efficiency, and technology acceleration.

Notes

1 The Empire State Development-defined Capital Region consists of eight of the 11 counties in the U.S. Office of Management and Budget-defined Albany-Schenectady CSA. Excluded from the Capital Region but included in the CSA are Fulton, Montgomery and Schoharie counties.

Don’t miss these insights into the trends that are shaping the Capital Region’s economy. Sign up for CEG’s e-news and follow us on: