Capital Region Manufacturing Evolves: Continued Growth of Chemical-Based Manufacturing

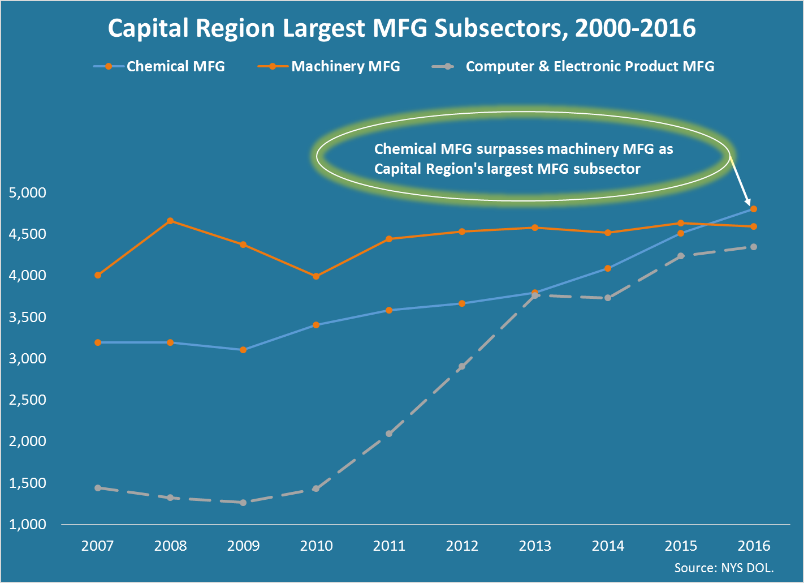

As the Capital Region celebrates Manufacturing Month this October, it will do so at a time when that sector is larger and economically more impactful than it has been in years. Illustrative of the dynamic changes the sector has undergone over the past 10 years, chemical manufacturing in 2016 unseated machinery manufacturing as the region’s largest manufacturing subsector in terms of employees, according to a Center for Economic Growth (CEG) analysis of New York State Department of Labor statistics.

Large MFG Subsectors

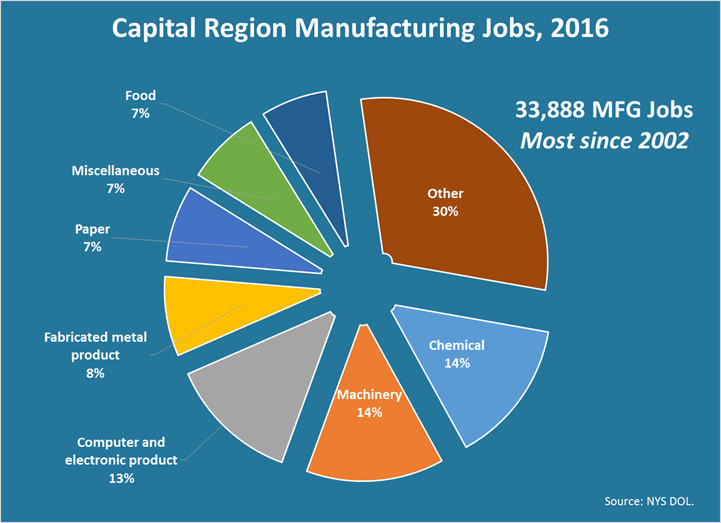

Manufacturing employment throughout the eight-county region last year climbed to 33,888 – up 19.7 percent from 10 years earlier. Driving much of that growth were the chemical manufacturing and computer and electronic product manufacturing subsectors, employing 4,801 and 4,347 in 2016, respectively. Machinery manufacturing – long anchored in the region by General Electric in Schenectady – had 4,588 employees in 2016. That was 213 less than chemical manufacturing and 241 more than computer and electronic product manufacturing.

Capital Region chemical manufacturers include Regeneron in East Greenbush, SI Group in Niskayuna, Momentive Performance Materials in Waterford and SABIC in Selkirk. Computer and electronic product manufacturers include GlobalFoundries in Malta. Over the past 10 years, the region’s chemical manufacturing subsector has grown by 50.4 percent and the computer and electronic product manufacturing subsector has grown by 201.7 percent. Meanwhile, during that period, machinery manufacturing has grown at a slower rate of 14.5 percent.

MFG Diversification

In 2016, chemical, machinery, and computer and electronic product manufacturing accounted for 40.5 percent of all manufacturing jobs throughout the region, compared to 27.1 percent in 2007. Other sizeable subsectors included fabricated metal product manufacturing (8 percent), such as Dimension Fabricators in Glenville; paper manufacturing (7 percent), such as Mohawk in Cohoes and Finch Paper in Glens Falls; and food manufacturing (7 percent), such as Bilinski Sausage Manufacturing in Cohoes.

Bigger Economic Impact

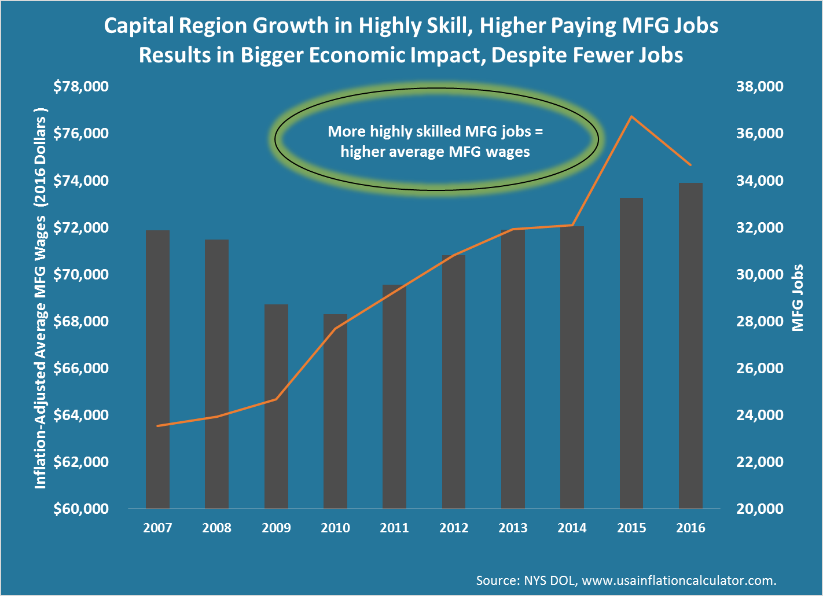

The manufacturing sector is now having a substantially greater economic impact on the region’s economy than it did 10 years ago. Manufacturing wages in 2016 totaled $2.53 billion – up 25 percent from 2007, when taking inflation into account (2016 dollars). During that 10-year period, the average manufacturing wage rose to $74,675 from an inflation-adjusted $64,535 (2016 dollars) – largely driven by an increase in more highly skilled, higher-paying jobs.

Chemical MFG Talent Pipeline

Supporting the growth of the region’s chemical manufacturing sector is a robust talent pipeline primarily established by the Rensselaer Polytechnic Institute and University at Albany. In the 2015-2016 school year, Capital Region institutions awarded 204 degrees (bachelor, master and doctor) in chemistry-related fields, including chemical engineering, biochemistry, and chemistry, according to a CEG analysis of Integrated Postsecondary Education Data System statistics. Sixty percent of those degrees were awarded at RPI. Other local institutions that awarded chemistry-related degrees include Siena College, Skidmore College, The College of St. Rose and Sage Colleges. An additional 227 degrees in pharmacy and pharmaceutical studies were awarded at the Albany College of Pharmacy and Health Sciences.

County MFG Highlights

Each of the eight counties contribute to the Capital Region’s manufacturing dynamic. Below is a sampling of each county’s 2016 manufacturing highlights:

-

Capital Region

- 6 percent of manufacturing establishments have less than 50 employees (2015) – above U.S. small manufacturer average (84.3 percent).

-

Albany-Schenectady-Troy MSA

- Seventh most thriving manufacturing city in U.S. – Forbes, 2017.

-

Albany County

- 7,791 manufacturing jobs – most jobs in region, 16th most in NYS.

- $66,802 average annual manufacturing wage – 12th highest in NYS.

-

Columbia County

- 3 percent of manufacturing establishments have less than 50 employees (2015) – second highest concentration of small manufacturers in the region.

-

Greene County

- 2% percent of manufacturing establishments have less than 50 employees (2015) – highest concentration of small manufacturers in region (tie).

- Six addition small manufacturing establishments (less than 50 employees) over five years (2015) – second biggest gain in region, 10th biggest gain in NYS (tie).

-

Rensselaer County

- 1,264 manufacturing jobs added over five years (+43.4%) – fastest-growing county in region.

- $78,077 average annual manufacturing wage – seventh highest in NYS.

-

Saratoga County

- 1,397 manufacturing jobs added over five years (+21.7%) – greatest number in region.

- $86,051average annual manufacturing wage – 6th highest in NYS.

-

Schenectady County

- $91,564 average annual manufacturing wage – third highest in NYS.

- $1.011B manufacturing exports – most in region.

-

Warren County

- 1,222 women in manufacturing jobs (38.7 percent) – highest concentration in region. (Annual average beginning of quarter counts)

-

Washington County

- 2,644 manufacturing jobs (17.3 percent all jobs) – highest concentration in region, ninth highest in NYS.

-

Warren and Washington County PUMA

- 14th highest revealed comparative advantage (RCA) in the medical equipment and supplies industry, based on the number of employees in this area’s industry, compared to the size of the area’s total labor force at the size of the industry nationwide.

Sources: NYS DOL, US BLS, US Census Bureau: County Business Trends, QWI Explorer, Brookings Institution, Deloitte: Data USA.

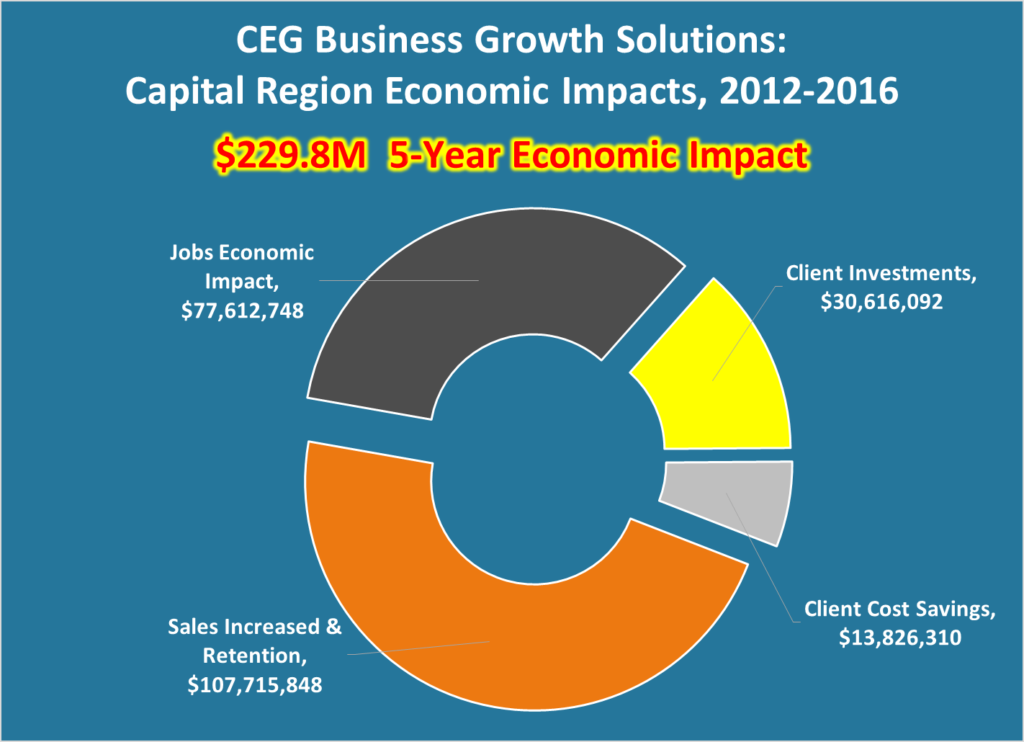

CEG Business Growth Solutions

As the Capital Region’s Manufacturing Extension Partnership (MEP) Center, CEG’s Business Growth Solutions (BGS) unit helps local manufacturers become more efficient, tap into new markets and grow. It assists manufacturers with continuous improvement, technology acceleration, energy and sustainability, supply chain development and workforce and education initiatives. Over the past five years BGS has had a $229.8 million economic impact in the region’s manufacturing sector. That includes helping create or retention of more than 1,600 jobs.

Skilled Manufacturing Workforce

To ensure the Capital Region has a talent pipeline to not only sustain but also accelerate manufacturer’s growth, CEG and its partners are taking steps to improve access to and career advancement within the manufacturing sector. As follow up to The Pathways Project for Advanced Manufacturing study that it conducted last spring for the Capital Region Workforce Development Boards, CEG and Hudson Valley Community College (HVCC) are developing a new, stackable credential program for workers interested in entering the manufacturing workforce. This multi-level program will provide workers with ways to quickly attain skills that area manufacturers need, initially through 18-20 hours of on-line classes (Level 1) followed by an 80-hour intense BOOTCAMP offered over two consecutive weeks (Level 2).

Furthering efforts to attract and retain skilled workers is CEG’s Talent Connect program, which helps outside talent recently employed by local companies adjust to living in the Capital Region while also assisting their spouses or partners find employment here. Talent Connect staff also travels outside the region – to places such as Fort Drum and MIT – to recruit talent for CEG investors in the Capital Region.

Don’t miss these insights into the trends that are shaping the Capital Region’s economy. Sign up for CEG’s e-news and follow us on: