Capital Region Businesses Awarded $1.6 B in PPP Loans

Nearly 250 lenders approved $1.6 billion in Paycheck Protection Program (PPP) loans for Capital Region businesses, with the construction, healthcare and social assistance, and professional and technical services sectors receiving the most in relief funds. KeyBank emerged as the eight-county region’s leading PPP lender, with its total loan amount and volume being more than double that of any other lender, according to a Center for Economic Growth (CEG) analysis of new U.S. Small Business Administration data.

The new SBA data provides more current loan information and details on sub-$150,000 loans than the earlier PPP statistics that CEG reported on in July. Using updated data, CEG identified 15,418 PPP loans awardees in hamlet, villages, towns and cities throughout the region’s eight counties, totaling $1,635,783,524. That means, when combined with the $442 million in SBA Economic Injury Disaster Assistance Loans (EDILs) that local businesses received during the pandemic, the region’s total amount of federal COVID-19 relief aid exceeded $2 billion.

Below are highlights from the new PPP data:

Loan Volume

Of the $1.6 billion, $457.7 million was for 13,217 loans under $150,000 and $1.78 billion was for 2,201 loans over $150,000. While loans over $150,000 accounted for 14.3 percent of the total loan volume, they represented 72 percent of the total amount approved.

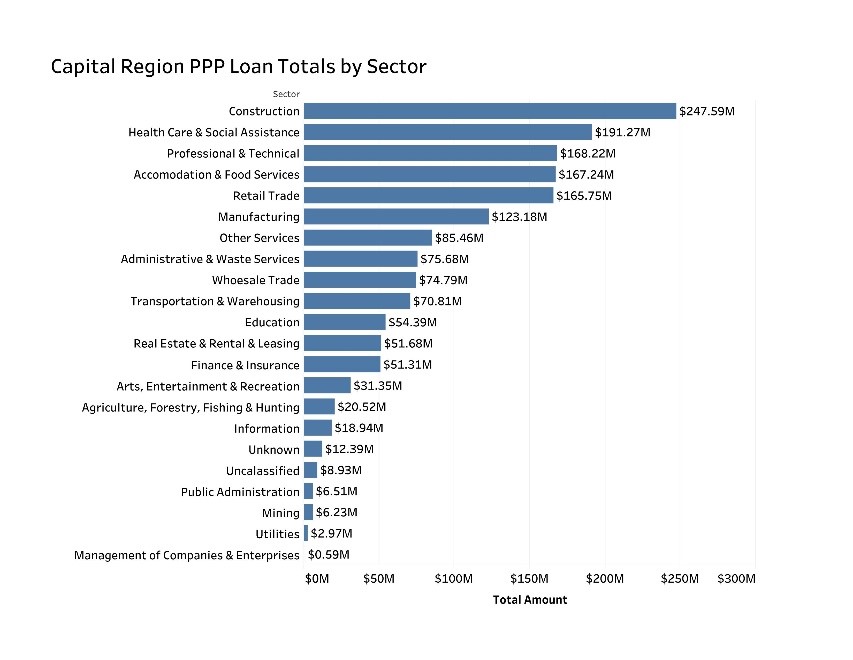

Sectors

At $247.6 million, construction firms received the most in PPP loans, followed by healthcare and social assistance at $192.3 million, and professional and technical services at $168.2 million. However, the greatest number of loans went to professional and technical services (2,028), other services (1,725) and construction (1,694). The hard-hit accommodation and food services sector, which includes hotels and restaurants, had the fourth greatest sum of PPP loans ($167.2 million).

Lenders

The Capital Region’s top lenders by amount were KeyBank ($387.5 million), M&T Bank ($128.3 million) and Adirondack Trust Company ($98.4 million). While the average loan was $106,096, the median loan was $26,917.

Business Type

Corporations, limited liability companies (LLCs) and S-corps accounted for nearly three quarters of PPP loans (71 percent), though they accounted for nearly four-fifths of the total amount awarded (81 percent). At $144 million, nonprofits accounted for the fourth greatest amount of PPP loans. Sole-proprietorships ranked third for the number of loans (2,401) and fifth for total amount ($47.5 million).

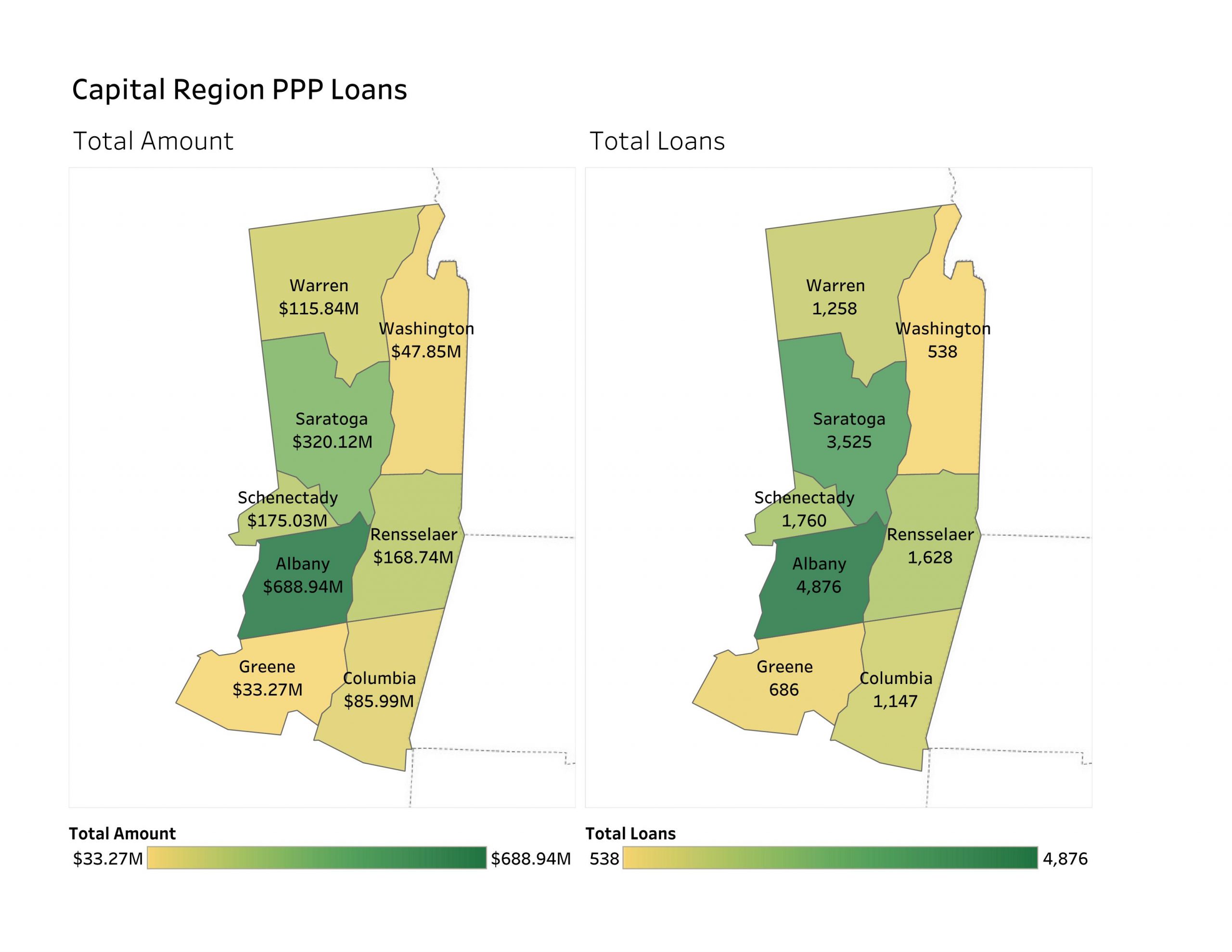

Counties

Albany County received the greatest amount ($688.9 million) and number (4,876) of PPP loans in the region. Excluding Saratoga County, Albany County received more PPP funds than all the other counties in the region combined. Saratoga County had the second greatest amount ($320.1 million) and number (3,525) of PPP loans.

CEG Initiatives

At the height of the pandemic last spring, both the Capital Region Chamber and its affiliate, CEG, advised businesses on EIDL and PPP loans. CEG has also supported Capital Region businesses through the COVID-19 pandemic by helping them meet workforce reduction mandates, pivot to make personal protection equipment and medical equipment, and prepare for the restart of the regional economy. CEG also awarded $200,000 from COVID-19 Emergency Fund to 41 Capital Region minority and women-owned business enterprises (MWBS) and veteran-owned business enterprises (VBEs).

Don’t miss these insights into the trends that are shaping the Capital Region’s economy. Sign up for CEG’s e-news and follow us on: